Completing CDD across complicated ownership structures

Dealing with clients whose ownership involves layers of different entities

This article explains the best practice for performing Client Due Diligence on clients whose ownership involves layers of different entities.

For example:

Company A is entirely owned by another Company, Company B, which a single natural person owns. This person is a beneficial owner of Company A and so must be identified as a CDD Candidate in its AML Workflow.

OR

A trust has a corporate trustee Company that effectively controls the trust. The trustee Company has two directors, Ms Jones and Mr Davies, who both must be identified as CDD Candidates in the trust's AML Workflow

Contents

1. Connect the entities' profiles

3. FAQs

Connect the entities' profiles.

Completing CDD across the interconnected Company and trust structures begins with ensuring all entities requiring CDD are correctly linked in Connectworks.

First, check the Client list in Connectworks to ensure all the interconnected entities are loaded in Clients>All.

If they are not loaded (or only appear in your Clients>Contacts list), load the missing entities before proceeding.

Adding a Company as a Shareholder:

-

Navigate to the Company workspace, then to the Parties Tab and select the Other Organisations tab at the top.

-

If Nature: Contact shows, this indicates the companies are not connected correctly. A duplicate profile is held in your contacts list (likely created by a Companies Office import). Before proceeding, you must follow the steps outlined in our article How to Remove Duplicate Companies in your Contacts List.

- If the Company does not appear in the Other Organisations tab, add it using "I would like to..." and then add the Company/organisation.

Adding a Corporate Trustee to a trust:

1. Navigate to the trust workspace, then to the Parties tab.

2. Check if the associated Company shows the Nature = Client.

3. If Nature = Contact, the Companies are not connected. You must follow the steps outlined in Scenario 2: The Duplicate Company is Part of a Trust

Performing CDD

To perform Client Due Diligence, you will need to identify the person(s) who are the beneficial owners or who have the authority to act for your clients. When these natural persons are removed from the Client by layers of ownership structure, there are two ways to complete the CDD process in Connectworks:

Option 1

If the entity most closely related to your Client's beneficial owners is also a client of your firm, you should first perform CDD on that most closely related Client and then link the record of that CDD to the CDD of the original Client.

For example, say a client of your firm (Company A) is entirely owned by another client of your firm (Company B), which is entirely owned by a single natural person. You want to identify this person as the beneficial owner of Company A.

In this case, you should first complete the AML compliance workflow on Company B. This allows you to verify the person's identity with Company B.

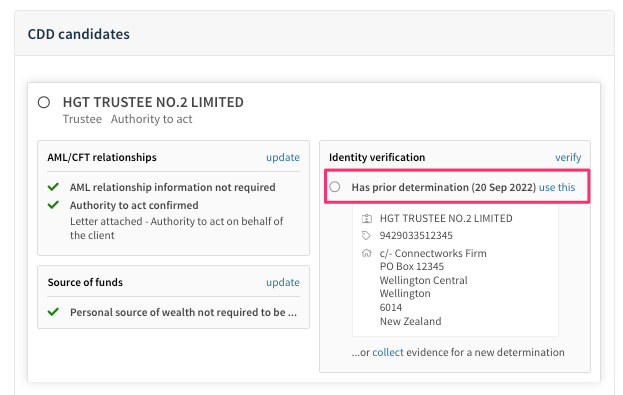

Subsequently completing the AML compliance workflow on Company A, you will be able to select Company B as a CDD Candidate and then link in the previously completed CDD determination on Company B without having to enter any further information (see screenshot below).

Option 2

Alternatively, if the entity most closely related to the beneficial owners of your Client is not itself a client of your firm, you can add the ultimate beneficial owners directly as associated parties of the Client so that they can be selected as CDD Candidates in the Client's workflow.

FAQ's

Q. I've imported a Shareholder/Trustee Company to perform CDD and discovered it has another Company as a shareholder! What do I do?

You have discovered a "Russian doll" of companies - unfortunately, it's a common situation! You need to proceed with importing the shareholder companies until you reach one with only natural-born persons as shareholders. Then perform the AML compliance workflow on each entity, starting with the furthest from the original entity and linking each completed CDD to the next.

Q. The second Company is not one of my clients, so I cannot complete its AML compliance workflow. How do I perform CDD on the owners of the second Company to fulfil my obligations to perform CDD on my client Company?

Option 1 (recommended): Even though it's not your Client, we recommend importing the company on our $5 AML-only subscription. This will quickly bring through the director and shareholder information and enable you to perform CDD, which can then be linked back to your client entity.

Option 2: Alternatively, the owner/s of the second company can be added as associated parties of the first company, which will enable them to be selected as CDD Candidates in your Client's AML workflow.

Q. How can I tell if a company or trust I've selected as a CDD Candidate has already completed a full AML workflow?

This is displayed in the final workflow step, "review and confirm". If you do not see the text "Based on CDD Determination made by (staff name) on (date)", then the AML Compliance workflow has not been completed for the associated entity.