Consolidating and Splitting Shares

How to consolidate or split shares in Connectworks

This article explains how to perform a share consolidation or split (sub-division).

The share consolidation is increasing the par value of a share. Shares of the same value are combined to become shares of a larger value. The share consolidation reduces the number of shares a company has in issue and then every shareholder exchanges a set number of existing shares for a set number of new shares.

Share split (sub-division) is decreasing the par value of each share. Shares of a larger nominal value are divided into shares of a lesser nominal amount. The share sub-division increases the number of shares a company has in issue and then every shareholder exchanges a set number of existing shares for a set number of new shares.

How to record a share split or consolidation

1. Navigate to the company's workspace, then to the Shareholders tab.

2. Select "I would like to..." then "Split/consolidate shares"

3. Details of the share split/consolidation

-

Date of Adjustment

-

Class of shares being adjusted

-

Share adjustment

-

A split: 1 share before the split will be equal to (number of shares) after the split.

-

A consolidation: (number of shares) before the consolidation will be equal to 1 share after the consolidation.

-

Mixed: where the ‘before and after’ multiplier does not equate with a factor of 1. For example, if 2 shares before are becoming 3 shares after.

-

From total: enter the total number of shares there will be after the split or consolidation, and then Connectworks can work out the formula needed to arrive at that figure.

-

-

Transaction Status

-

Other information (Supporting comments)

Dealing with Residuals

Sometimes when splitting or consolidating shares, the number of shares held by a particular shareholding before the split/consolidation may not arrive at a whole number after the split/consolidation.

For example: In a situation where 10 shares of a class have been issued, a 3-for-1 consolidation will result in 1 share being left over. These leftover shares are called residuals.

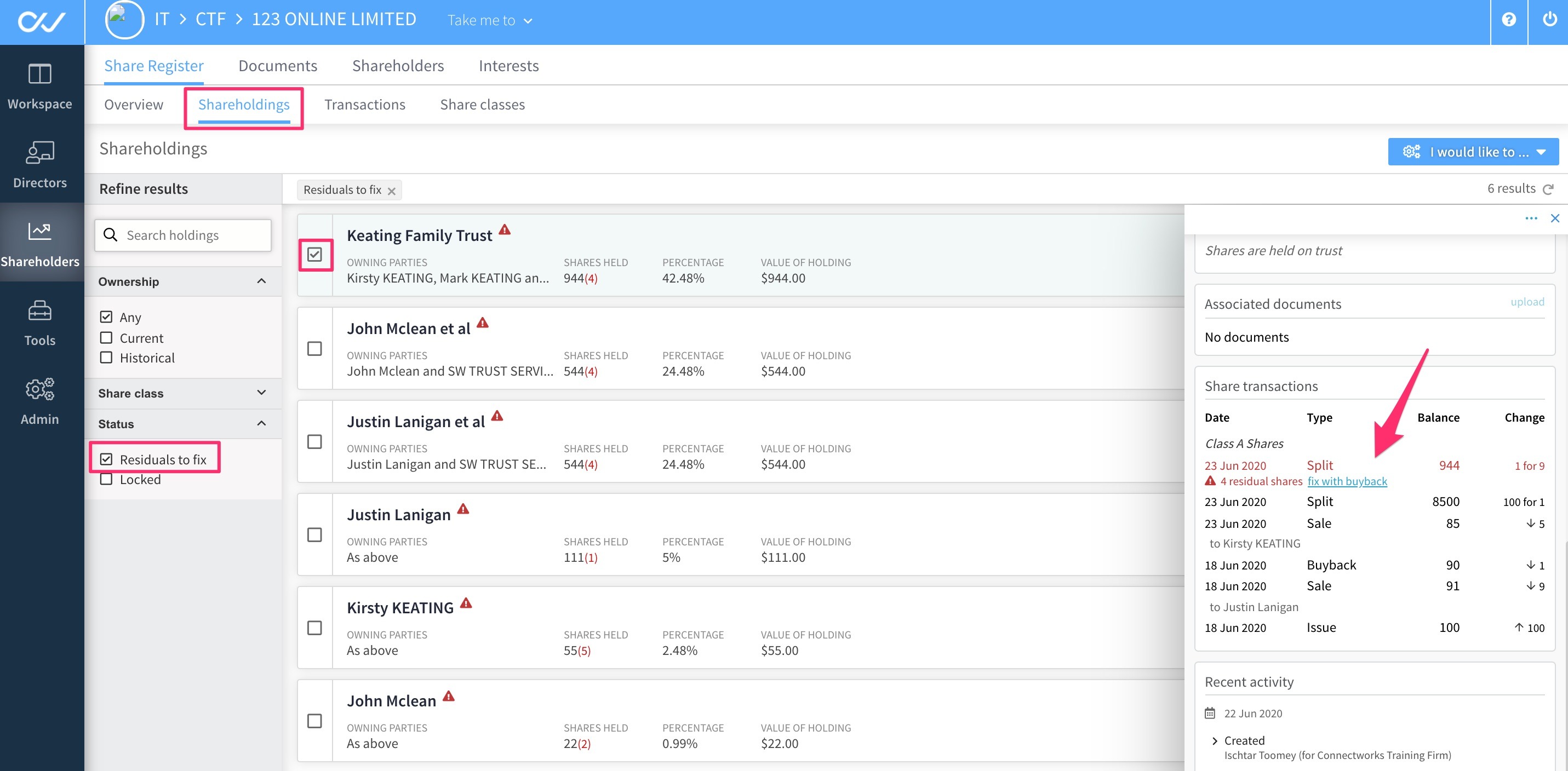

If an allocation has residuals, an alert flag will display in the shareholder's gallery. The number of residual shares will also show. (Note that the number of residuals is at the ratio before the split or consolidation). These shareholdings can also be identified via a filter on the left.

If a shareholding has residual shares, it can be resolved by using a buyback to purchase those shares from the shareholding. However, a buyback needs board approval. It is recommended to seek advice before resolving residuals.

The image below displays the easiest way to record a buyback in this scenario. By selecting the link from this screen, the Buyback shares form will be pre-populated with the residual share information relating to the allocation.