Pending and Trial Transactions

Share transactions created within Connectworks

When transactions are created within Connectworks they are posted to the share register by default; this means that they become part of the formal register of share movements as maintained by the company. A transaction that is part of the formal register we shall refer to as having been posted.

There are times when one may wish to create a transaction that is not posted. Such as:

-

Creating a draft as part of a longer-running workflow,

-

To take advantage of the automatic generation of the documentation before shares are formally transferred, or

-

See the effect of one or more transactions on the register (such as changes in holdings and shareholder continuity)

To achieve this transactions can be assigned one of two non-posted statuses: pending and trial. This may be done on the creation of the transaction or at any time by editing the transaction.

Share calculations

Share calculations, including percentage ownership, are performed on an entire body of share transactions. In the case of the formal register, this consists of all posted transactions.

Regarding pending transactions, Connectworks performs the calculations on those transactions that are either posted or pending. That way you can see the effect a transaction will have on the formal register before actually posting it to the register.

Example: ABC Limited issues on incorporation 10 shares to Jill and 10 shares to Jack. They are recorded in Connectworks which calculated that each has 50% of the issued shares of the company. Jill and Jack want to know the effect on their percentage of voting rights if the company issues another 20 shares to a potential investor Jane. They create a pending transaction in Connectworks representing that issue and Connectworks calculates a pending balance of 25% each for Jill and Jack and 50% for Jane. This calculation considers both the existing share transactions (those posted) and the pending transactions to Jane. Later they decide not to take on the investment and delete that transaction.

As for trial transactions, these extend beyond pending so share calculations are performed on all posted, pending and trial transactions together.

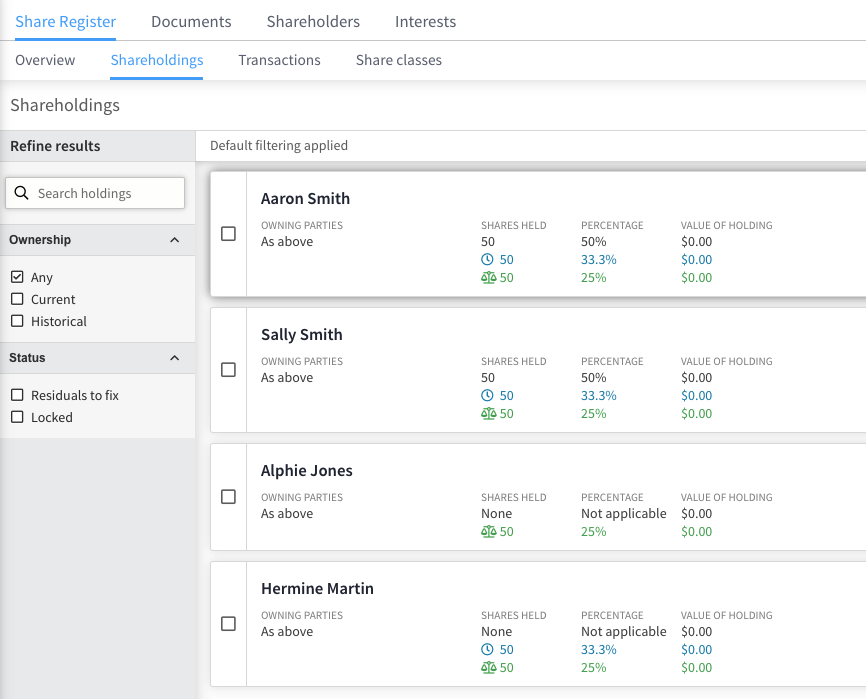

Example: ABC Limited with 100 shares on issue raises some capital and finds two investors Alphie and Hermine who are willing to take 50 shares each. They created two trial transactions: one for Alphie and one for Hermine. With those transactions, they send each a share subscription agreement. Alphie returns a signed agreement and the transaction is changed from trial to pending; awaiting formal issue by the company board. An existing shareholder who has 50 shares in the company asks what their voting rights are. The company is able to tell them it is 50% right now but there are 50 shares pending approval from the board. When those are approved it will drop to 33%. However, there are 50 more shares on offer and if they are accepted it will drop to 25%.

To see the effect of pending and trial transactions on shareholders these are displayed in the shareholdings gallery.

The revised share calculations on shares held, percentage and value of holding are displayed in blue for inclusion of pending transactions and green for pending and trial transactions. These only appear if there is a difference that affects any of the numbers inclusive of rounding.