Shareholder continuity tracking in Connectworks

How to use the shareholder continuity feature within Connectworks

Share class settings are used for calculations.

As shareholder continuity is linked to controlling, the voting rights of each share class are critical to any calculations. These settings are covered here and cover:

-

Make a dividend or distribution

-

Approve a change to the constitution

-

Elect a director

-

Vary the capital of the company

-

Defined under Section YA1 of the Income Tax Act 2007

-

NB. This is different to how rights are defined under the Companies Act 1993

Contents

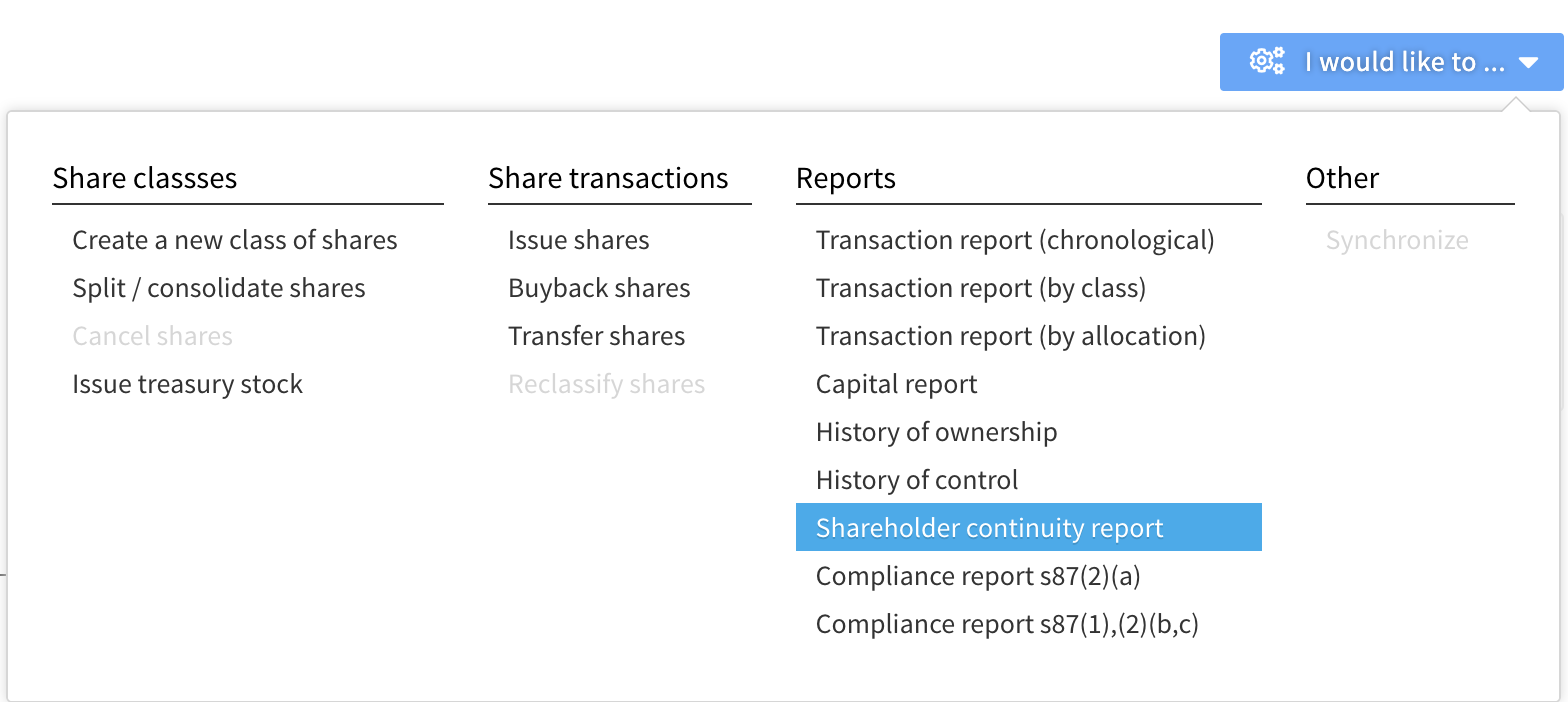

Generating the reports

In the Company Shareholders tab>Share Register>Overview

“I would like to”

-

History of Ownership (XLS, CSV and PDF)

-

History of Control (XLS and PDF)

-

Shareholder Continuity Report (XLS and PDF)

Important factors in using the reports

-

Testing is to determine the ‘Average percentage of control’ across all 4 areas of control.

-

To do this, we consider each shareholding in turn and report the ‘minimum average percentage of control’ retained over the test period.

-

The values are added up across each shareholding, with the sum being a percentage of overall retained control over the test period.

-

The result is based on the percentage of all shares that could vote for each control, across all share classes.

-

We currently treat each shareholding as a separate shareholding for the purpose of the calculation.

-

i.e. Tracing through to ultimate beneficial owners is not provided currently.

-

E.g. if there are two separate companies as shareholders, both controlled by the same person, they are not currently combined and are treated as one shareholding.

-

Connectworks provides some ability to show ultimate beneficial ownership (primarily for AML/CFT purposes). It is recommended that you use this and other sources if you’re unsure of ownership.

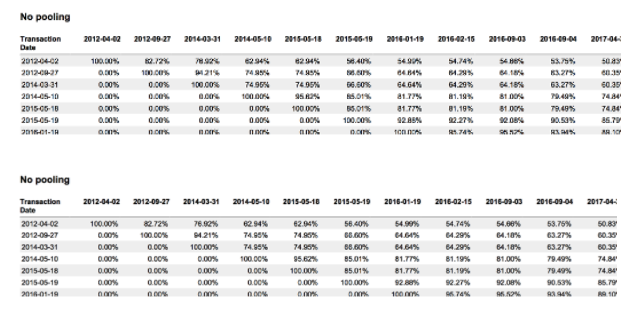

Calculating Continuity of Control (without pooling)

-

Use the ‘History of Control’ report and ‘Continuity lookup tables’.

-

If there is pooling, refer to the next section.

-

Dates shown are when share transactions occurred.

-

The result shown for each date is immediately after the transaction(s) occurred.

-

So use dates immediately before the imputation of the imputation credits or losses and before the end of the calculation period.

-

Losses incurred 31/3/13. The calculation is to 31/3/16.

-

You would therefore use figures for 27/09/12 and 15/02/16.

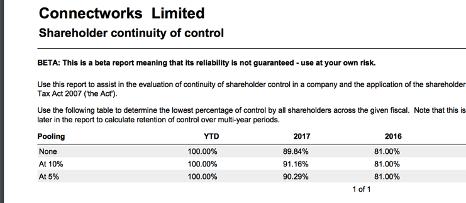

Helping complete IR4s

-

To quickly answer Q40 of current IR4 (Lowest economic interests of the shareholders during the income year), use the shareholder continuity of control report.

-

Use the figure for the end of the corresponding tax year.

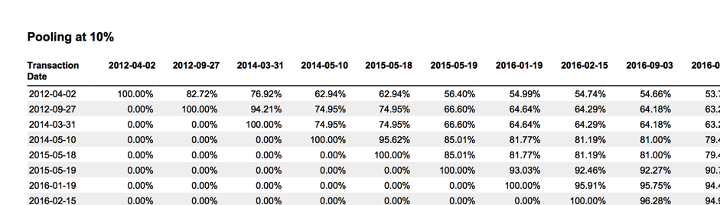

Pooling

-

Optional, but the legislation does allow for it where there are large numbers of small shareholders.

-

We support pooling at both 10% and 5%.

-

We only include a shareholder in the pool if they meet the criteria across the entire period.

-

I.E. A shareholder with 9%, then 11%, then 8% control would be eliminated from the pool calculation (as they went temporarily above 10%).

-

An initial inclusion in the pool would otherwise give rise to a continuity change of 11%.

-

As mentioned, each allocation is currently treated as being owned by a single notional person. So allocations ultimately owned by a single shareholder need to be combined.

-

Select the 5% or 10% threshold table.

Select dates immediately before the start and end of the test period.

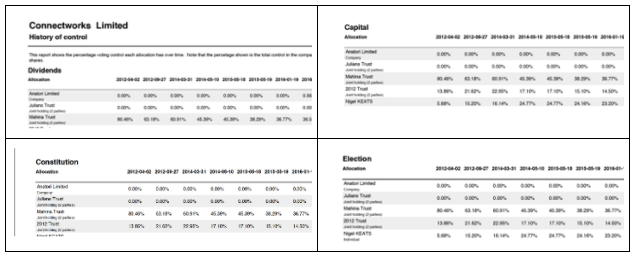

History of Control

-

The ‘History of Control’ report gives you the ability to drill down by shareholder, by transaction, and by class of control to determine how the overall calculation was compiled.

Disclaimer

-

The above help centre article and content in Connectworks are not to be considered advice of any type.

-

The solution Connectworks has developed is in beta, and as such reliability cannot be guaranteed.

-

Maintaining accurate and timely shareholding details in Connectworks is a critical part of the process of working correctly.

-

This includes recording rights attached to share classes and using the dates share transactions occurred, not when they were recorded at the Companies Office.