Meeting the Trust Act 2019 record-keeping requirements with Connectworks

Trust Act 2019 record-keeping requirements

Background

The Trusts Act comes into force on 30th January 2021. It acknowledges that trusts are often multi-party entities - commonly one or more settlors/trustees and one or more professional trustees or advisors. In order for the trustees to be able to make informed decisions relating to the trust, they should hold, or have access to all relevant trust records.

It also acknowledges that trusts are long-term arrangements (up to 125 years under the new Act) and that there may be changes of trustees over the life of the trust. Record-keeping requirements have therefore been prescribed in sections 45-48 of the Act. These obligations apply with retrospective effect. So they apply to all documents created since the trust was settled, not just new ones added after the Act comes into force.

The provisions of the Contract and Commercial Law Act 2017 permit that all records and documents can be held electronically which would apply to all core documents.

What does the Act say?

Section 45

Each trustee of a trust must keep, so far as is reasonable, the following documents relating to the trust:

-

The trust deed and any other document that contains the terms of the trust.

-

Any variations made to the trust deed or trust.

-

Records of the trust property that identify the assets, liabilities, income, and expenses of the trust and that are appropriate to the value and complexity of the trust property.

-

Any records of trustee decisions made during the trustee’s trusteeship.

-

Any written contracts entered into during that trustee’s trusteeship.

-

Any accounting records and financial statements prepared during that trustee’s trusteeship.

-

Documents of appointment, removal, and discharge of trustees (including any court orders appointing or removing trustees).

-

Any letter or memorandum of wishes from the settlor.

-

Any other documents necessary for the administration of the trust.

-

Any documents referred to in the paragraphs above that were kept by a former trustee during that person’s trusteeship and passed on to the current trustee.

Section 46

If there is more than 1 trustee of a trust, each trustee must comply with the obligation in section 45 by:

(a) holding the documents specified in section 45(a) and (b) or copies of those

documents; and

(b) being satisfied that at least 1 of the trustees holds the other documents specified in section 45 and that those documents or copies of them will be made available to the other trustee or trustees on request.

Three options to comply:

Option 1 (s45)

All trustees are given all documents and records that they keep in their own way somewhere secure and accessible. Each new or updated document or record is required to be distributed to all other trustees for them to save.

Option 2 (s46 b)

One trustee (the record keeper) gathers and holds all records and documents of the trust (in Connectworks or elsewhere). They create a list of them that they distribute to the other trustees (letting them know they exist and are available). When another trustee requires one, they request it from the record keeper who finds it and supplies it. When another trustee creates new documents or updates records, they either advise the other trustees that they exist, (and records are held in two places) or send them to the recordkeeper to keep, who then advises the other parties of their existence and supplies them with it when/if requested.

Option 3

The trust uses Connectworks on a subscription plan giving all trustees access. All trustees have ready access to all of the trust's documents and records. They are held securely and are easy to find from anywhere in the world (with internet access) at any time. Any document or record that is added or updated by any party is automatically and instantly accessible to all other trustees.

Section 47

“A trustee must keep, so far as is reasonable, the documents for the duration of the trustee’s trusteeship”

In Connectworks:

Maintaining a Connectworks subscription for the trust delivers this (and much more). Unless otherwise selected, Connectworks converts trust documents to PDF/A format. The ‘A’ stands for Archive. It identifies a "profile" for electronic documents that ensures the documents can be reproduced exactly the same way using various software in years to come, as defined under the ISO standard 19 005 it meets.

Section 48

“At the time that the trusteeship of a trustee ends, if the trust continues, the trustee must give at least 1 replacement trustee or continuing trustee the documents that the trustee holds at that time”

Over the (up to) 125-year life of a trust available under the new Act, it is likely that there will be a change of trustee several times. If the trust chooses to have documents and records centrally located and that record keeper dies, is divorced, or is otherwise disassociated with the other trustees this could become problematic.

In Connectworks:

If one party is to change/has changed, simply assign access rights to the new party. The new party instantly has access to all of the trust's records and documents uploaded by all parties since it was settled (if saved in Connectworks).

Disclosure of information to beneficiaries

Sections 49-55 of the Act outline requirements around the disclosure of certain trust information to beneficiaries. This article isn’t designed to deal with the decision-making process around what is disclosed and to whom. We have produced a beneficiary-disclosure workflow and draft letter to beneficiaries to address this.

However, we can address, in a practical sense, how information can be shared with beneficiaries using Connectworks.

Option 1:

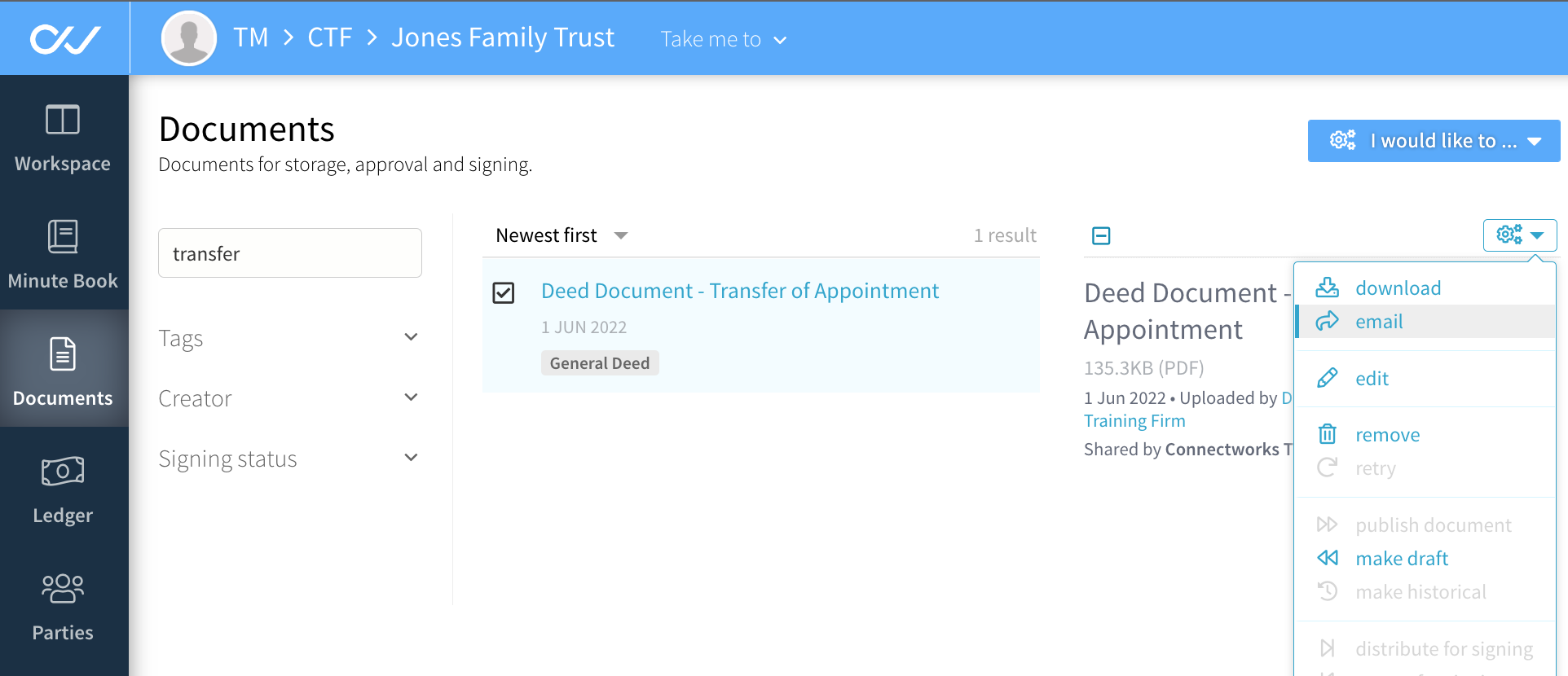

Email documents directly from within Connectworks. Learn more about this feature in our article here.

Option 2:

Download documents from Connectworks to include in another email or print. Other reports can also be produced and downloaded.

Learn more in our articles Storing & Accessing Documents and Generating Reports

Option 3:

We will be implementing a beneficiary access option if there is demand. This would include no access to the trust's minute book as beneficiaries don’t have the right to see this. It would also be ‘read-only’.

The opportunity is to make it easier and more cost-effective to give required beneficiaries access to information directly, rather than downloading all relevant information when required and sending it to each beneficiary.

What next?

Given these very detailed but simple requirements, the onus will now be on trustees to develop systems and arrangements to ensure effective compliance.

As a cloud-based system that can connect all the people involved in the trust and all their information, Connectworks can help with this and much more...