Beneficiary Disclosure Tracking

Beneficiary Disclosure Tracking -Trusts Act 2019

Under the Trust Act 2019, trustees of a trust are required to disclose certain information to beneficiaries of the trust (although there are exceptions to this requirement). Connectworks beneficiary disclosure tracking features allow firms to record whether, when, and what information is to be disclosed to the beneficiaries of the trusts the firm is involved with.

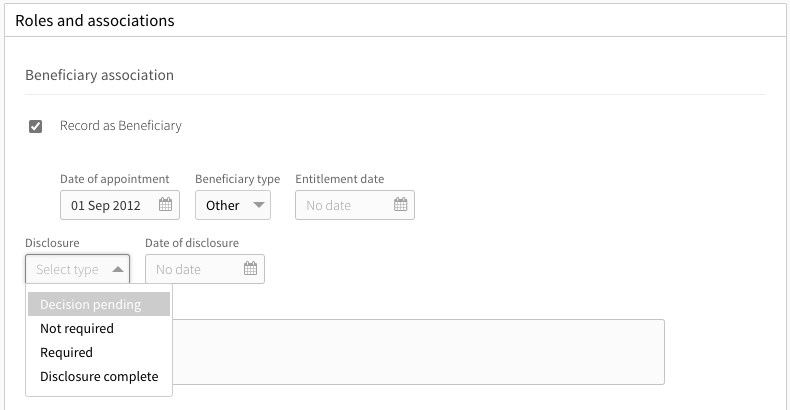

The Disclosure dropdown is used to flag whether the beneficiary requires disclosure to be made. By default, the dropdown is set to decision pending.

-

Decision pending - indicates that a decision about making a disclosure to the beneficiary hasn't yet been made.

-

Not required - indicates that disclosure isn't required;

-

Required - means that disclosure is required; and

-

Disclosure complete - indicates that disclosure was required, but that it has been made.

In the case of required, the date of disclosure field can be used to record the date the disclosure is to be made. This can be updated when the status is progressed to disclosure complete if required (if the disclosure was made on a different date than previously indicated).

The Notes field can be used to record what information is to be disclosed, as well as any other notes the firm wishes to enter. The beneficiary type, disclosure and disclosure date can be reported via the trustee report.

The above disclosure tracking features can be used in conjunction with the ‘Beneficiary Disclosure Workflow’ currently available to users.