Debt & Gifting

Acknowledging & forgiving debt in Connectworks

Trusts are commonly loaned money by third parties (ie. parties other than banks or other financial institutions, usually the trust's settlors) who then periodically forgive the trust's debt in an activity called gifting.

Connectworks can be used to record acknowledgements of trust debt and to record and track its forgiveness. (Note that Connectworks can also record loans from banks or other persons or institutions that require to be repaid. These are discussed in the article Recording and repaying Mortgages or other loans)

When a trust receives money from a third party by way of a loan, the debt must first be acknowledged via an Acknowledge debt transaction (detailed below), after which it can be forgiven via a Forgive debt (gifting) transaction.

Third-party debt and gifting that is tied directly to the purchase of an asset can also be recorded as part of the Acquire an asset transaction. All other debt and gifting should be recorded as per the process outlined below.

Contents

Acknowledge Debt

If required, Connectworks has a variety of precedents available to assist your firm in generating the required documents to acknowledge a debt.

To acknowledge a debt that can be gifted:

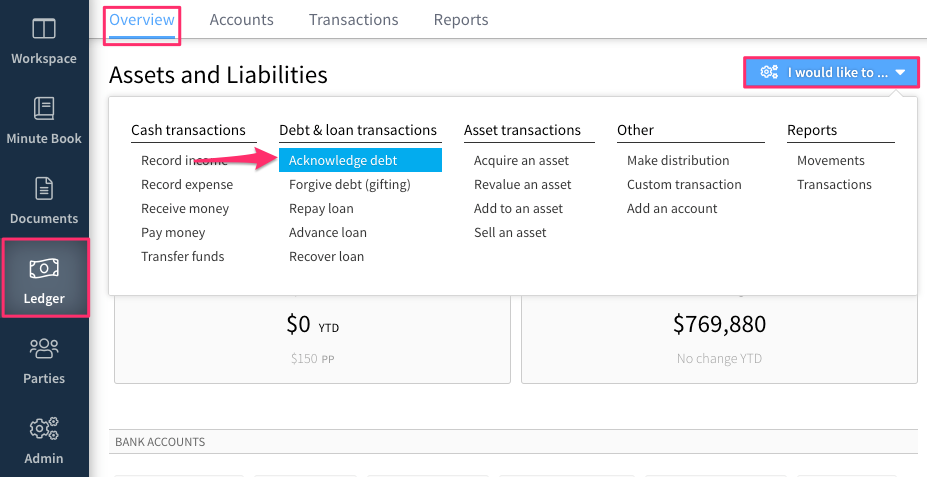

1. Navigate to the trust's Ledger>Overview tab.

2. Click on the "I would like to..." drop-down and select Acknowledge debt from the menu.

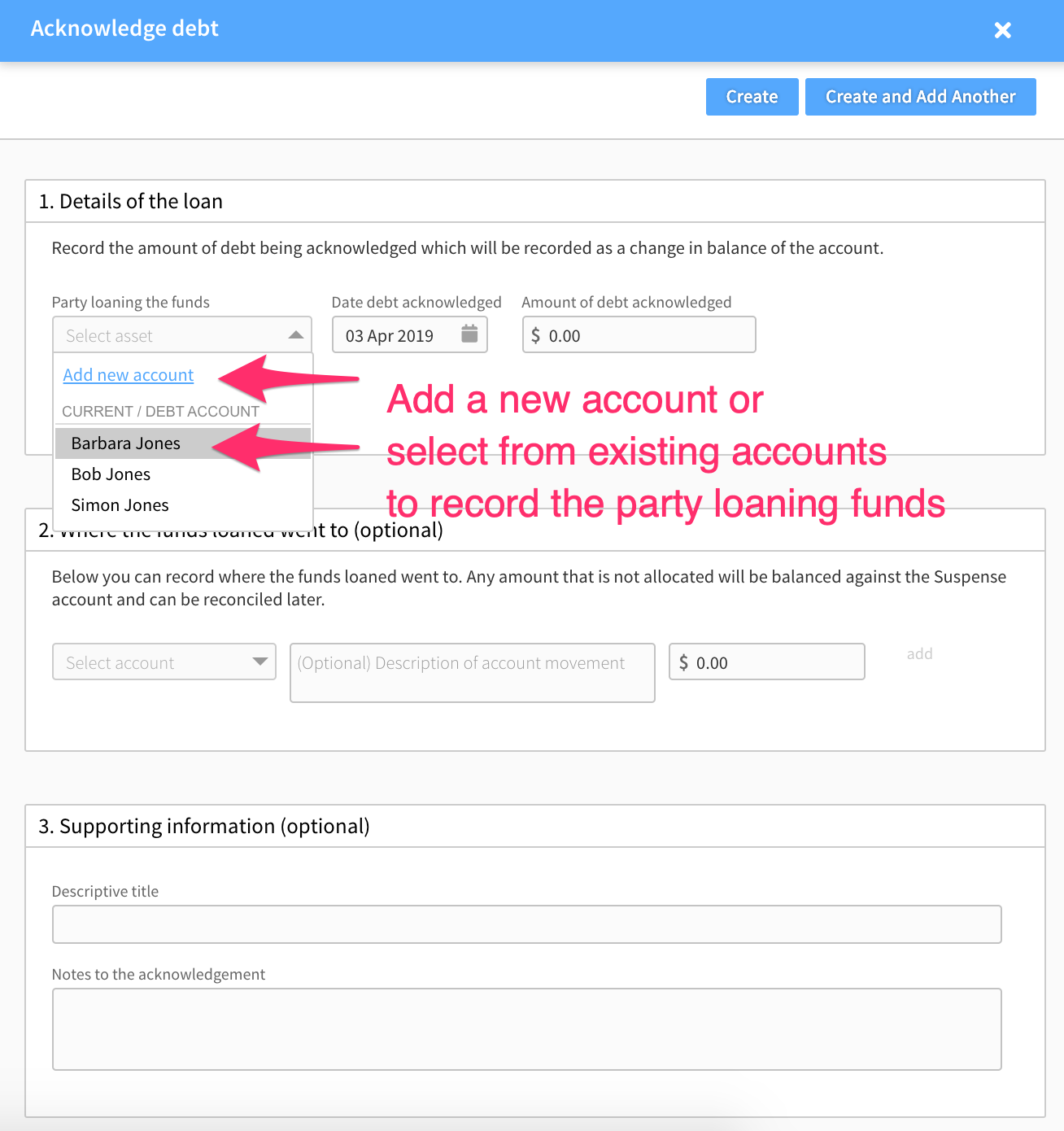

3. A slide-out form will appear. Here you can record:

-

The party loaning the funds - You may either select an existing account from the list of non-bank current or debt accounts that have been created for the trust or create a new account to record the debt against.

-

The amount of debt being acknowledged - This will be recorded as a change in the balance of the account loaning the funds.

-

The date the debt was incurred.

4. You can then record where the loaned funds went to. Again, either select an existing account or create a new account. The amount of the loan will then be credited against this account, to balance the amount debited against the source of the loan account.

If you choose not to allocate the proceeds of the loan into an account, the unallocated amount will automatically be balanced against the trust's Suspense account and can be reconciled later. For more on using and reconciling the suspense account, see the article here.

5. Add any supporting notes, then select Create in the top right to save the acknowledgement of debt.

Forgive Debt (Gifting)

If required, Connectworks has a variety of precedents available to assist your firm in generating the required documents to forgive a debt.

Once a debt to a third party has been acknowledged, it is able to be forgiven or gifted down.

To record forgiveness of debt:

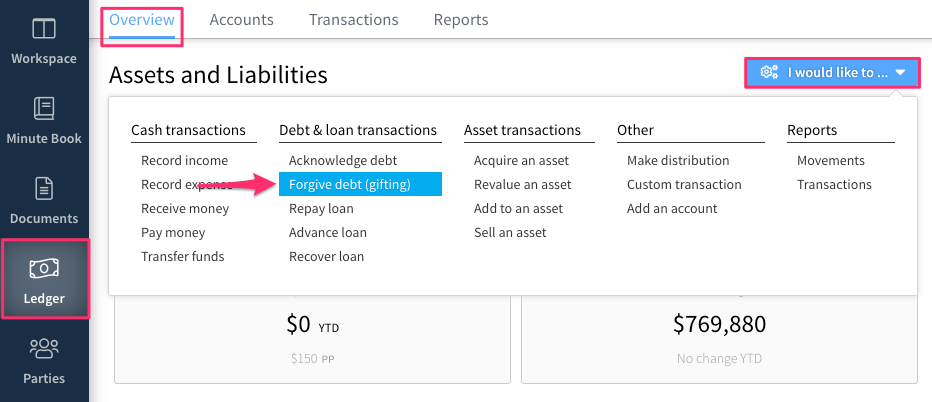

1. Navigate to the trusts Ledger>Overview tab.

2. Click on the "I would like to..." drop-down and select Forgive debt (gifting) from the menu.