Recording trust income

How to record trust income in Connectworks

This article describes how to record trust income.

In the context of recording trust income, these transactions are recorded against an income account. This income account records all funds received from a particular source of income (for example, a rental property).

Note that non-income-related receipts of funds (such as tax refunds) can also be recorded using the receive money transaction type.

How to record income

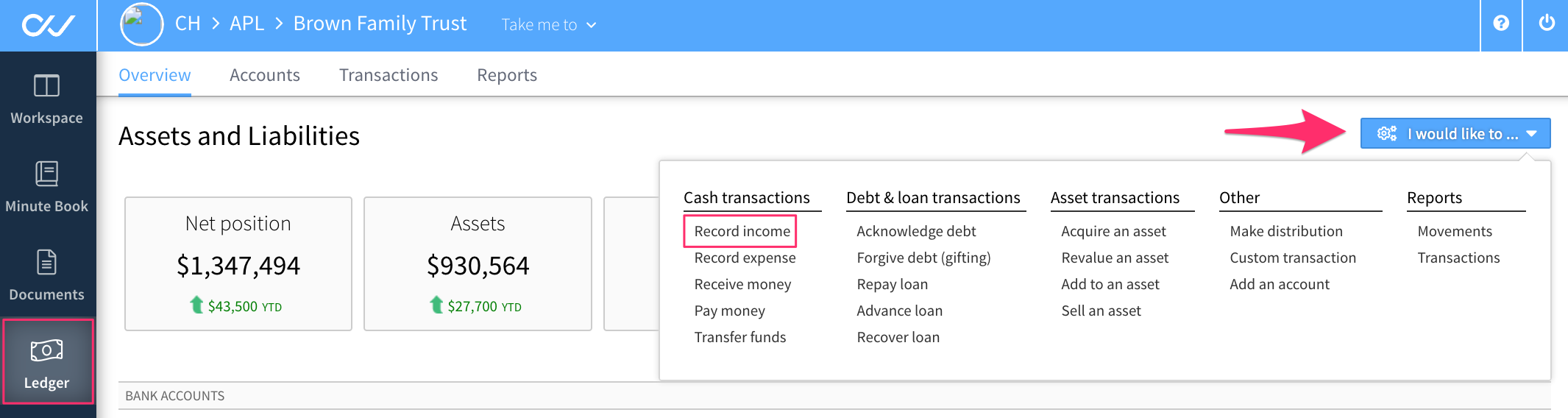

To record trust income, navigate to the trust’s Ledger and either:

1. Select Record income from the "I would like to..." menu

OR

2. Open the Chart of accounts, place a tick next to the income account you want to record the received funds against, and then click on the income button on the slide-out menu.

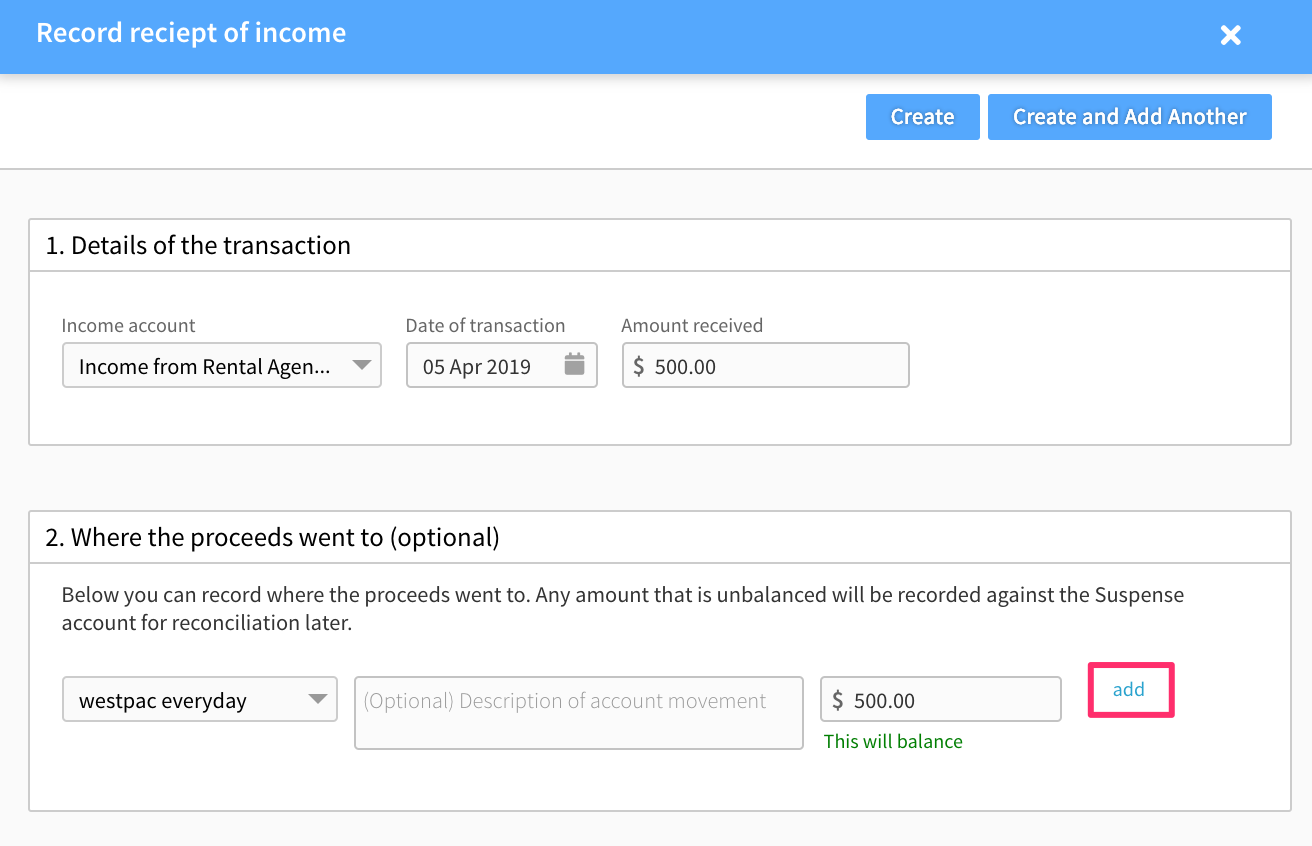

In the form that opens, record:

-

The source of income. You may either select an existing income account or create a new account to record the expenditure against.

-

The date of the payment.

-

The amount being paid.

You have the option to record the account the proceeds of the income went into. You can select from any existing account, or create a new account if required. If the funds have been received into multiple accounts you can split the proceeds across multiple accounts using the Add button (pictured below). Any amount that is unbalanced will be recorded against the Suspense account for reconciliation later.

If desired add a descriptive title and any supporting notes.

Save the transaction by selecting the Create button in the top right.