Pay/Receive Money

How to record receipts of funds from non-income sources / non-expense related payments of funds

This article explains how to record receipts of funds from non-income sources (such as tax refunds), and non-expense-related payments of funds (such as tax payments).

To record income or expense payments, read our articles here and here.

Contents

1. Recording receipts of funds

2. Recording payments of funds

Recording receipts of funds

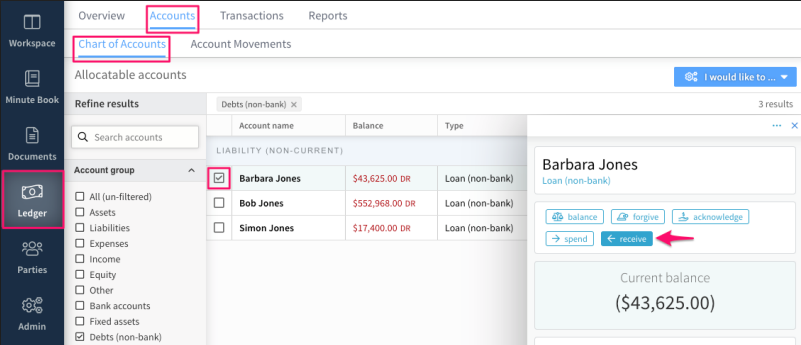

To record a receipt of funds, navigate to the trust’s Ledger and either:

1. Click on the "I would like to..." drop-down menu and select Receive money.

OR

2. Open the Accounts>Chart of Accounts section, place a tick next to the account you want to receive the funds into, and then click on the receive button in the slide-out menu.

In the form that opens, record:

The account the funds are being received into. You may either select an existing account or create a new account to record the funds against.

The date the funds were received.

The amount being received. This will be debited as a change in the balance of the account receiving the funds.

You can then record where the received funds came from. Again, either select an existing account or create a new account. The amount received will then be debited against this account, to balance the amount credited against the account receiving the funds.

If you choose not to allocate the source of the funds into an account, the unallocated amount will automatically be balanced against the trust's Suspense account and can be reconciled later. For more on using and reconciling the suspense account.

Add any supporting notes, then select Create in the top right to save the loan advance.

Recording payments of funds

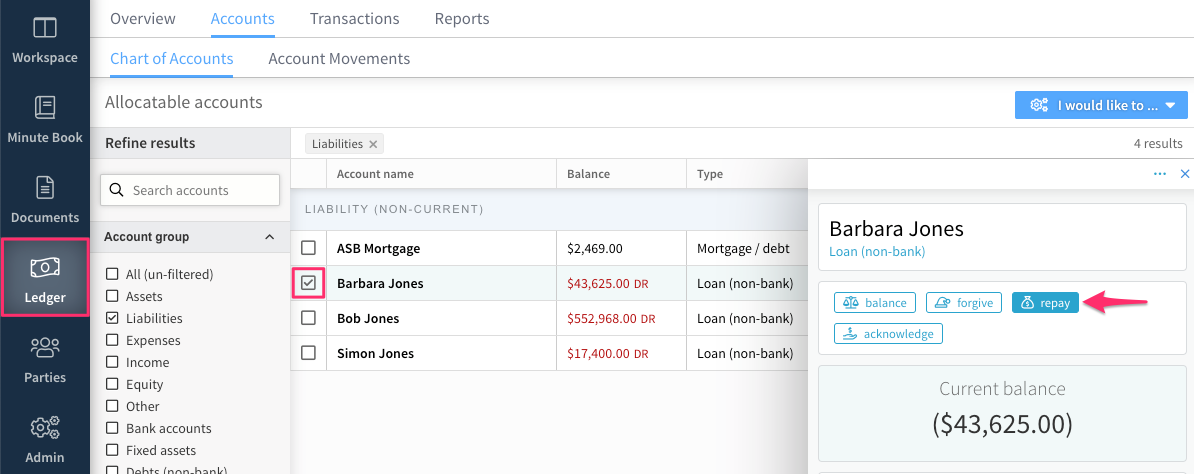

To record payments of funds, navigate to the trust's Ledger tab and either:

1. Click on the "I would like to..." drop-down menu and select Pay Money.

OR

2. Open the Accounts>Chart of Accounts section, place a tick next to the loan account you want to repay, and then click on the repay button on the slide-out menu.

3. In the form that opens the record:

-

The account the funds are being paid from

-

The date the payment was made

-

The amount being paid

4. You can then record where the paid funds went to. Again, either select an existing account or create a new account. The amount of the payment will then be credited to this account, to balance the amount debited from the payment account.

If you choose not to allocate the source of the repayment into an account, the unallocated amount will automatically be balanced against the trust's Suspense account and can be reconciled later. For more on using and reconciling the suspense account.