Selling an asset

Recording sales of trust assets in Connectworks

This article will guide you through the process of recording sales of trust assets. An asset can be sold in its entirety (e.g. selling a house) or only part of an asset can be sold (e.g. a reduction in stockholding in a company).

Before recording the sale of an asset, the acquisition of the asset must first be recorded in Connectworks as per instructions detailed in the article Buying or acquiring an asset.

Recording the sale of trust assets

To record the sale of a trust's asset(s), navigate to the trust's Ledger tab and either:

1. Click on the "I would like to..." drop-down menu and select Sell an asset.

OR

2. Open the Accounts>Chart of Accounts section, place a tick next to the asset you want to sell, and then click on the Sell button on the slide-out menu.

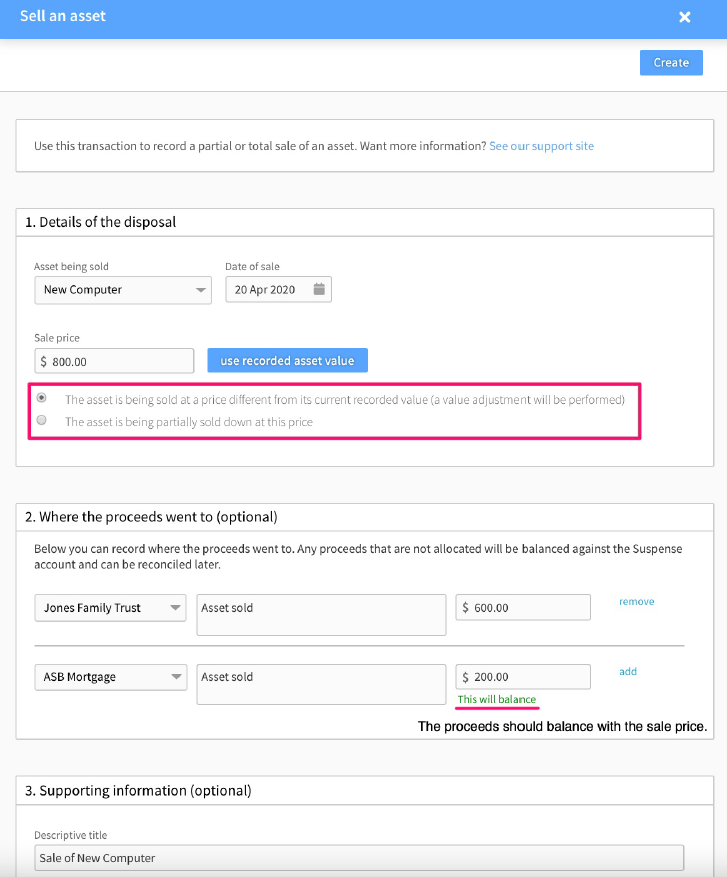

3. You will be directed to a Sell an Asset form. The asset you are selling will already be selected for you. Within this form you can record:

-

the date of sale

-

the account(s) the proceeds will be allocated to

-

the sale price of the asset.

NB. The sale price auto-populates as the purchase price or the most recent re-valuation. A sale can be either of an entire asset or only part of an asset.

In the case of the sale of the entire asset:

It will result in a sale transaction being created, and the account corresponding to the asset being adjusted. The sale may also result in a revaluation of the asset, this happens when the sale price recorded in the transaction is different from the current recorded value of the asset.

In the case of an asset being partially sold:

A revaluation transaction will be created (along with the sale transaction) to adjust the value of the asset up or down to the sale price. The revaluation will be the last valuation amount minus the sale amount.