How to create records of assets owned or held by a trust

This article explains how to create records of assets owned or held by a trust.

Contents

2. Recording the nature of the acquisition

3. Types of asset & asset accounts

5. Add supporting information and create

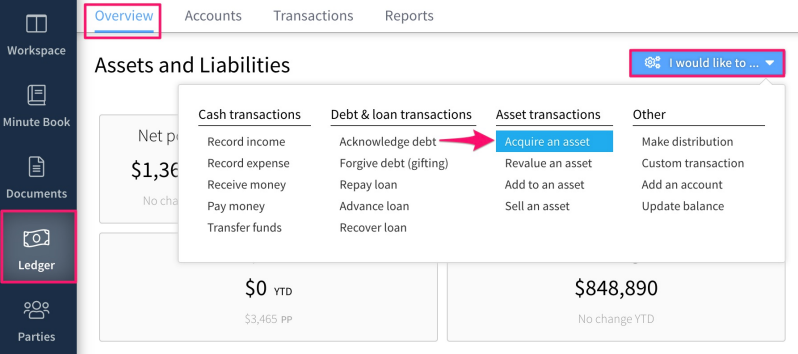

Acquiring an Asset

To record an asset for a trust, navigate to the trust's Ledger tab and select the "I would like to..." menu, then Acquire an asset.

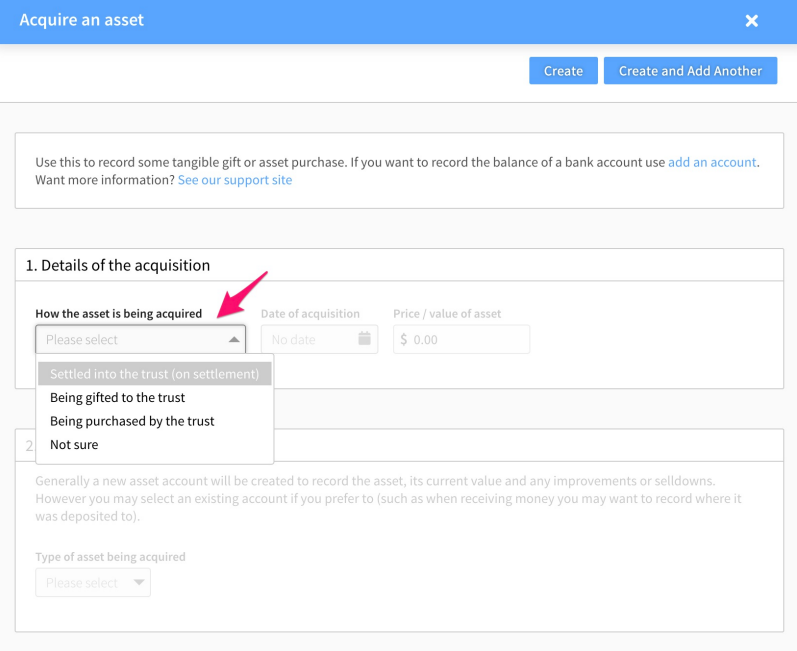

Recording the Nature of the acquisition

In the subsequent form, first, record how the asset is being acquired.

For historical transactions, we recommend you gather together the relevant paperwork (acknowledgement of debt, deeds of forgiveness, annual financial statements etc) and consider mapping out the transactions in chronological order first.

There are four options available for recording the nature of the acquisition, these are:

-

Settled into the trust (on settlement) - This records that the asset was settled into the trust as part of the trust settlement. (Note that this option can only be selected if a settlement date is recorded in the trust's profile. When selecting this option, the date of acquisition field will be locked to the trust's settlement date.

This method will automatically create the corresponding gifting to balance out the debt incurred. -

Being gifted to the trust - This records that the trust received the asset as a gift, other than during the settlement of the trust.

This method will automatically create the corresponding gifting to balance out the debt incurred.

-

Being purchased by the trust - This records that the asset was purchased by the trust.

Any debt or gifting will need to be recorded separately using this method.

-

Not sure - Use this option if you don't hold any records on the origin of the asset.

Any debt or gifting will need to be recorded separately using this method. This records that assets go up and suspense account goes down.

Once the method of acquisition has been selected, you must then record the date of acquisition and the value of the asset.

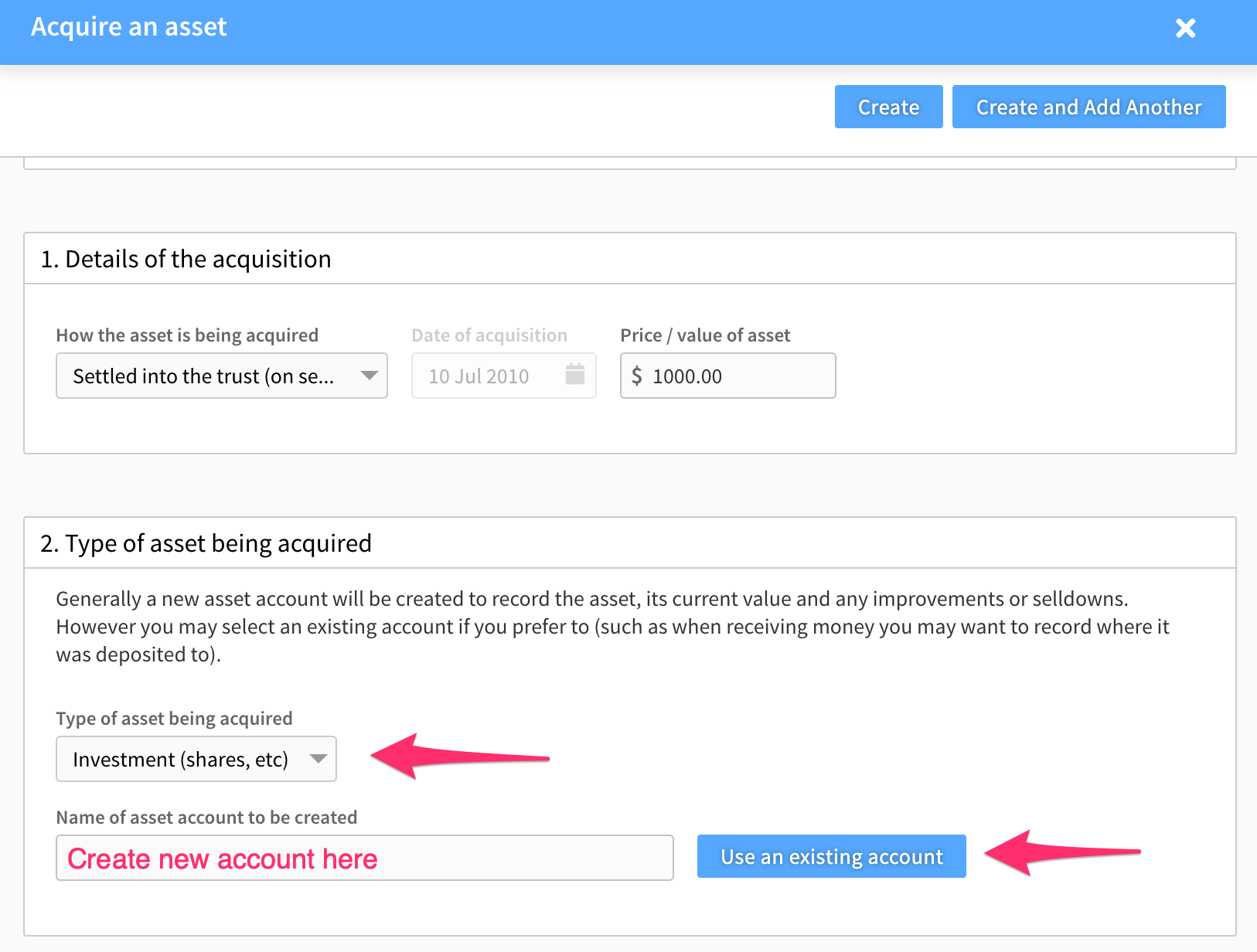

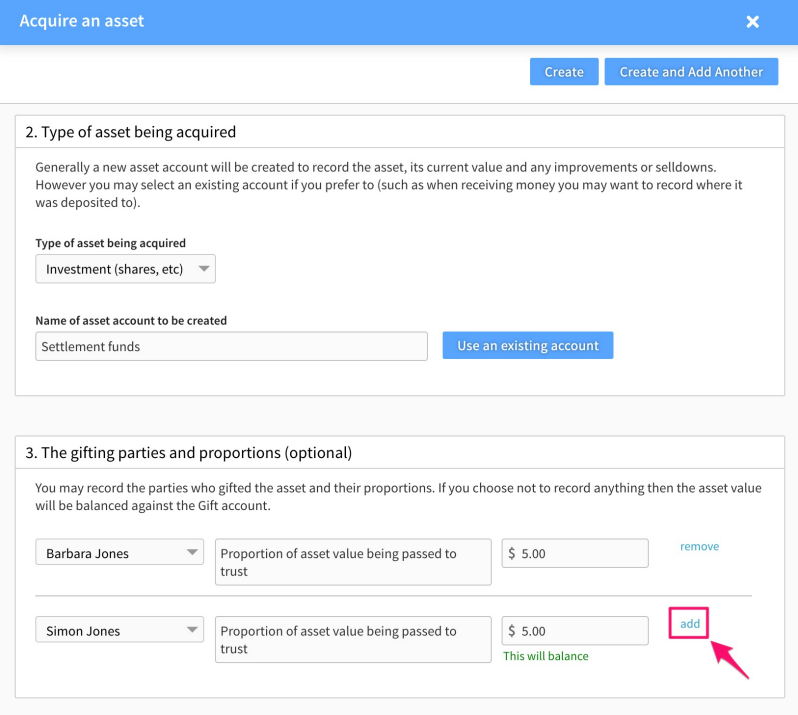

Types of asset & asset account

When a new trust asset is acquired, Connectworks automatically creates an account corresponding to that asset. Any additional transactions performed on the asset (such as sales or sell-downs, capital additions, or revaluations) are recorded as adjustments to the value of the asset account.

It is also possible to acquire assets against existing asset accounts. This may be done, for example, when cash is received as a gift and is deposited into a bank account that has already been manually created.

1. Once the nature of the acquisition, date of acquisition, and value of the asset has been entered, record the type of asset being acquired. There are two options available:

-

Real Estate

-

Investment (shares, etc)

-

Other (tangible property, etc)

2. Then either type in the name you would like to give your new asset account (which will be created when you have completed the form) or select the use an existing account option and choose an account from the drop-down menu.

How it was paid for

The movement of funds into an asset account that occurs when an asset is acquired can be balanced by recording a movement of funds out of another account (or accounts). This second movement traces the source of the funds that moved into the asset account.

Recording the origin of funds is optional. If you choose not to record anything then the asset value will be balanced against the suspense account.

Asset acquired as a gift or by being settled into the trust on settlement

Funds for assets acquired as gifts or by being settled into the trust on the settlement can only be sourced from non-bank current or loan accounts. To achieve this, accounts that have already been created for the trust can be selected from the dropdown menu, or a new account can be added when you record the asset.

If more than one account has contributed to the asset, you can record a portion of the gifted value against each contributing party by selecting the add button which appears after completing the details of the first party (see screenshot below).

If a source of funds is recorded upon creating the transaction two sets of balancing account movements will be recorded.

First:

-

The asset account will be credited with the value of the asset.

-

The source of funds/gift account(s) will be debited the value of the asset.

Second:

-

The source of funds/gift account(s) will be credited with the value of the asset.

-

The trust's gift account will be debited the value of the asset.

If no account is specified as the source of the funds/gift, the source of funds will be allocated to the trust's Suspense account.

Assets acquired by purchase

If the asset was acquired as a purchase, the source of funds account can be selected from the dropdown menu, or a new account can be added.

If more than one account has contributed to the purchase, you can record a portion of the purchase value against each contributing account by selecting the add button which appears after completing the details of the first account.

If an account or accounts are specified as the source of the funds/gift, then upon creating the transaction, two balancing account movements will be recorded:

-

The asset account will be credited the value of the asset.

-

The source of funds/gift account(s) will be debited the value of the asset.

If no account is specified as the source of the funds/gift, the source of funds will be allocated to the trust's Suspense account.

Add supporting information and create the asset

In the final section, you have the opportunity to add any additional notes on the asset acquisition.

Once all the above steps have been completed select Create in the top right and the asset will be recorded.

Supporting documents are uploaded directly into the documents tab, as outlined in our article Storing & Accessing Documents.