Recording and repaying mortgages or other loans

This article describes how to record the receipt and repayment of mortgages or other loans to the trust from third parties, where the loan is required to be repaid. To record debts or loans from non-bank sources, which can be forgiven or gifted, read the article here.

Contents

1. Recording the receipt of the loan

2. Recording repayments of the loan

Recording the receipt of the loan

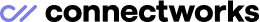

1. To record the debt, click on the “I would like to…” drop-down menu and select Acknowledge debt.

2. In the form that opens, record:

-

The party loaning the funds. You may either select an existing bank mortgage/loan account or create a new account to record the debt against.

-

Note - Loans against bank debt accounts can only be reduced by being repaid. Loans against non-bank debt accounts can be reduced by being repaid or gifted down.

-

-

The amount of debt being acknowledged. This will be credited as a change in the balance of the account loaning the funds.

-

The date the debt was incurred.

3. You can then record where the loaned funds went to. Again, either select an existing account or create a new account. The amount of the loan will then be credited against this account, to balance the amount debited against the source of the loan account.

If you choose not to allocate the proceeds of the loan into an account, the unallocated amount will automatically be balanced against the trust's Suspense account and can be reconciled later. For more on using and reconciling the suspense account, see the article here.

4. Add any supporting notes, then select Create in the top right to save the acknowledgement of debt.

Recording repayments of the loan

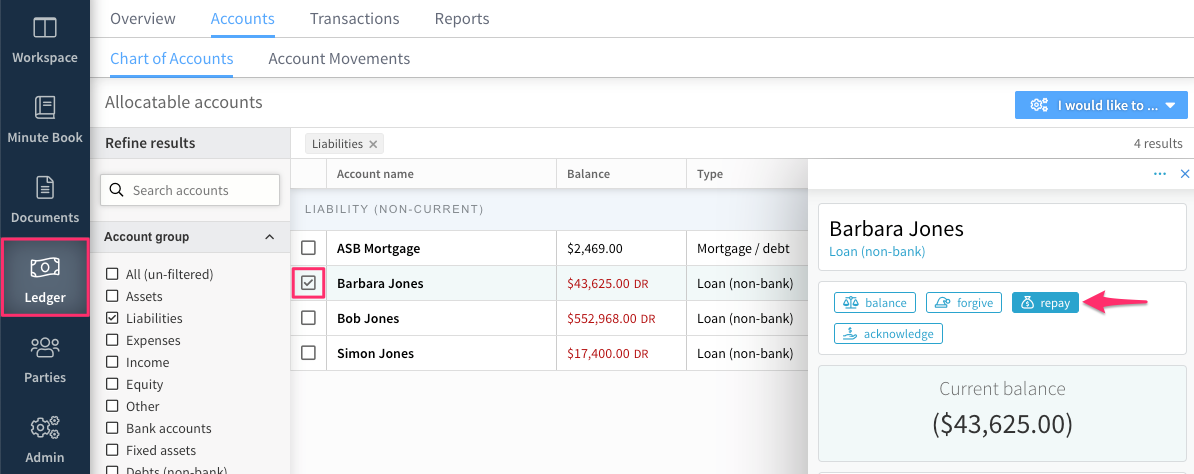

To record repayments of a loan, navigate to the trust's Ledger tab and either:

-

Click on the “I would like to…” drop-down menu and select Repay loan

OR

-

Open Accounts>Chart of Accounts section, place a tick next to the loan account you want to repay, and then click on the repay button on the slide-out menu.

-

In the form that opens record:

-

The loan account being repaid

-

The date the repayment was made

-

The amount being repaid

-

-

You can then record where the repaid funds came from. Again, either select an existing account or create a new account. The amount of the repayment will then be debited from this account, to balance the amount credited to the loan account.

If you choose not to allocate the source of the repayment into an account, the unallocated amount will automatically be balanced against the trust's Suspense account and can be reconciled later. For more on using and reconciling the suspense account, see the article here.