How to revalue an asset in Connectworks

Revaluation records a change in the value of an asset that has occurred, excluding changes occurring through capital being transferred into or out of the asset. Note that before you can revalue an asset you must first record its acquisition, as per our article here: Buying or acquiring assets.

Contents

Increase or decrease the value of an asset

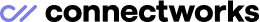

The value of any recorded asset can be increased or reduced. To revalue an asset, navigate to the trust's Ledger tab and either:

1. Select the "I would like to..." menu and Revalue an asset

or

2. Open the chart of accounts section, place a tick next to the asset you want to revalue, and then click on the re-value button on the slide-out menu.

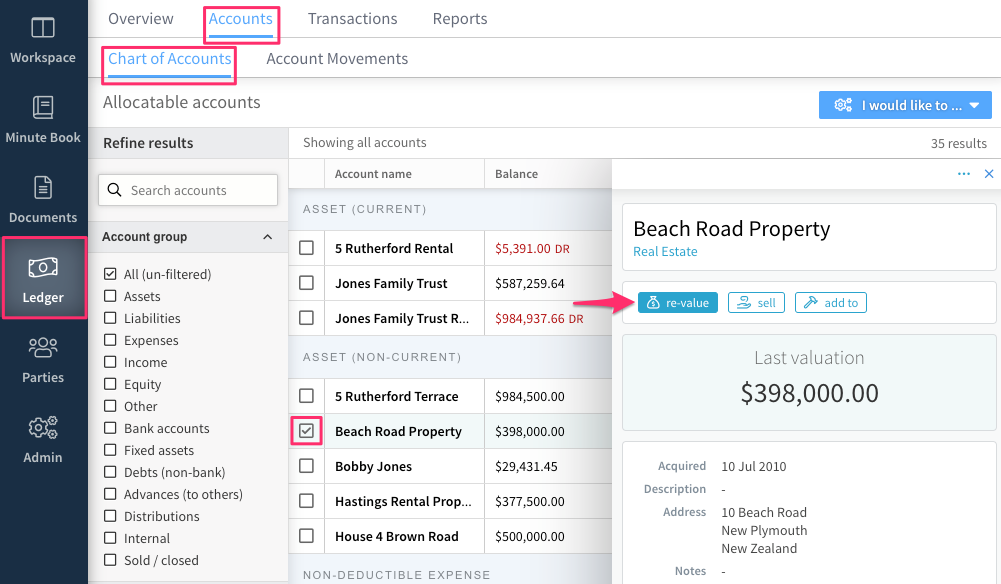

3. Update the valuation details and add any notes required, then select Create in the top right corner.

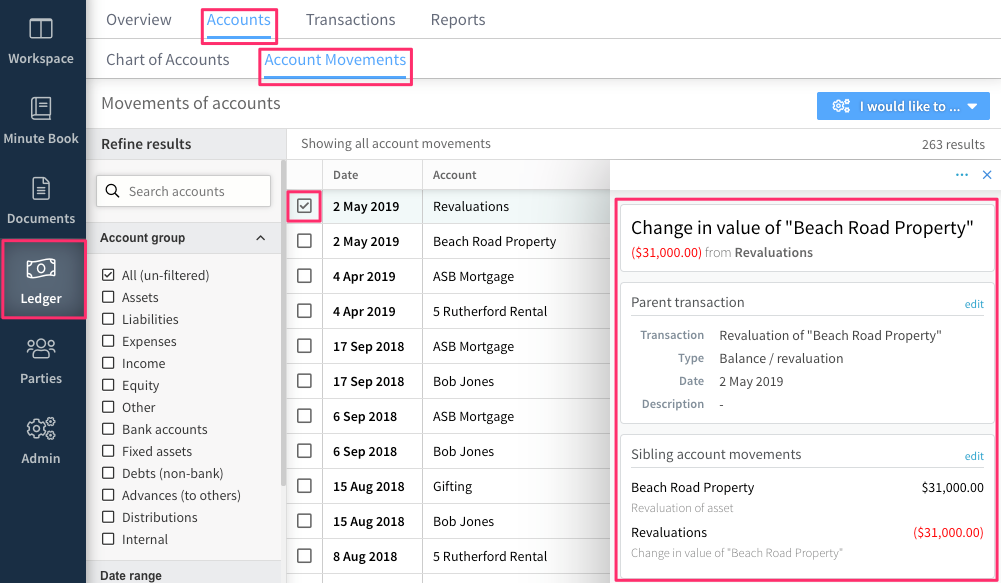

The new asset value will then be recorded against the asset in the Chart of Accounts. The value of the increase/decrease is displayed in the "Most recent Movements" section of the asset's slide-out menu, and also in the Account Movements tab, with further details available when selected.

As can be seen in the screenshot below, the difference between the previous and revised valuation is balanced against the trust's default Revaluation account.

Examples of Revaluation v. Capital Addition or Removal

Revaluation: Property valuation increases, or share value changes.

Capital addition: Renovations to a property, or purchasing additional shares.

The process for recording capital additions can be reviewed in our article Capital Additions and Removals

Capital removal: Selling part of an asset.

Capital removals can be recorded as per our article Selling an asset.