How to Edit Partnerships Profiles

Editing Partnerships profiles in Connectworks

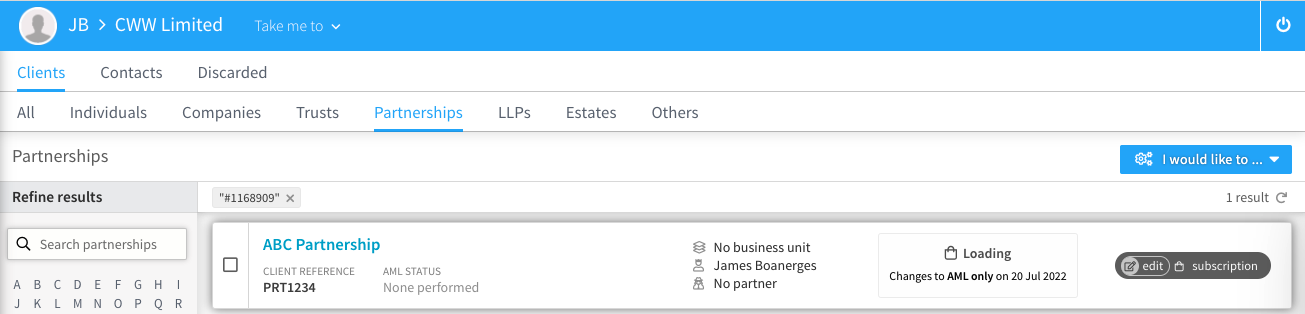

After a Partnership has been set up, a profile can be edited as follows

After selecting edit you will be directed to the update Partnership form, where you can add/edit all the essential details about the entity. Navigate between the tabs on the left, select Update to save information in each tab, or Update and close to exit the form.

Fields available to edit in the profile are:

Profile

General Details

-

Name

-

Name of Partnership

-

Trading name (if different)

-

-

Structure

-

Legal jurisdiction

-

-

Key Dates

-

AGM date

-

Commencement date

-

Contact Details

-

General

-

Email

-

Website

-

Primary phone

-

Other phone

-

-

Physical and Postal address

Tax & Finances

-

Tax residency country

-

IRD Number

-

GST Number

-

Tax code

-

Files tax return (not aware/yes/no)

-

Subject to foreign tax requirements (not aware/yes/no)

-

This is used to alert for the case where a member is a resident of another tax jurisdiction in a way that may affect how tax is treated.

-

-

Balance date

-

Subject to FATCA reporting (not aware/yes/no)

Client Admin

-

Management

-

General

-

Client reference (Reference or matter number)

-

Annual review date

-

-

Lifecycle

-

Set up status (see more here)

-

Summary notes

-

Associated Parties

The following article will guide you through the process of adding a Partner or Advisor to the Partnership

Notes

General notes about the client